The Basics of Commodities

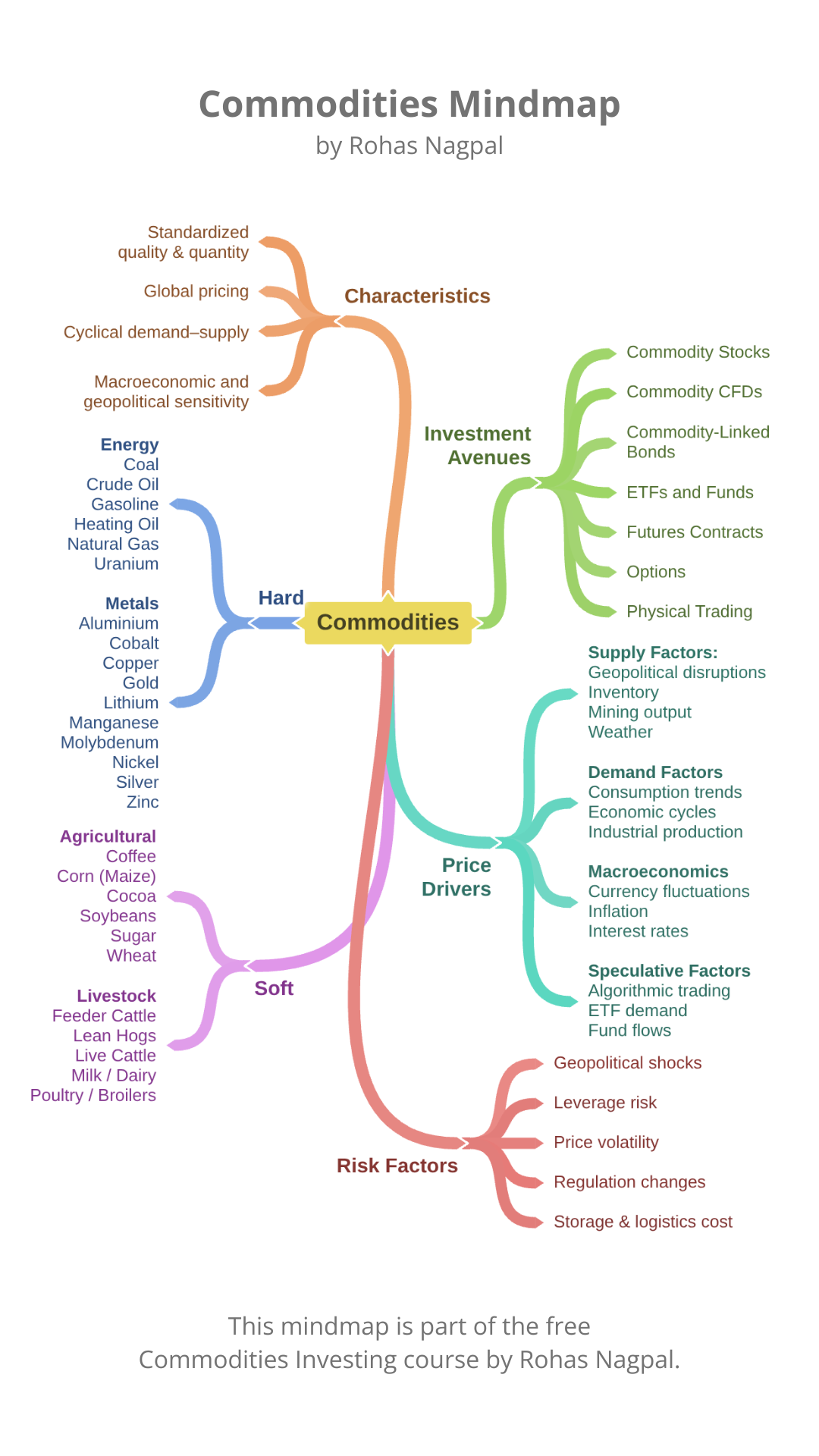

1. What are Commodities?

A commodity is a raw, basic good that is fungible - meaning it’s interchangeable with another unit of the same kind.

1 gram of 24K gold = another gram of 24K gold

1 barrel of crude oil = another barrel of the same grade

There’s no "premium" gold or "luxury" copper.

Hard commodities are natural resources that need to be extracted or mined from the earth. They typically have a longer shelf life compared to soft commodities and are more closely tied to industrial demand and global economic conditions, e.g., gold, copper, and coal.

Soft commodities are primarily agricultural products and livestock that are grown or raised. They are typically perishable and are significantly influenced by weather conditions, disease, and other environmental factors, e.g., rice and cotton.

Whether you realize it or not, commodities touch every part of your life.

🍚 You eat them (rice, wheat, corn).

☕ You drink them (coffee, tea, cocoa).

👕 You wear them (cotton, wool, rubber).

🔥 You burn them (oil, coal, gas).

📱 Your phone needs them (lithium, cobalt, nickel).

🤖 Even AI needs them (silicon, copper, gold).

Financial Commodities

Financial commodities are contractual or derivative representations of commodity value - not the physical goods themselves. These instruments are used primarily for speculation, hedging, and portfolio diversification.

Common examples include:

- Futures contracts

- Options on commodities

- Commodity ETFs or ETNs

- Synthetic assets (like Price Action Tokens)

Key characteristics:

- No physical delivery required: Most financial commodity instruments are settled in cash or offset before expiry.

- Accessible to broader investors: Financial products make it easier for retail and institutional investors to gain commodity exposure without managing physical inventory.

- Used for hedging and speculation: Financial commodities are central to risk management strategies and speculative trading in global markets.

Characteristics of commodities

Fungibility

Commodities are interchangeable. One unit of a given commodity is essentially the same as any other of the same grade or quality. For example, one barrel of Brent crude oil is equivalent to another of the same specification, regardless of origin.

Standardization

To facilitate trading on global markets, commodities are standardized in terms of quality and quantity. This allows for transparent pricing and smooth settlement in futures contracts and exchanges.

Global Tradeability

Commodities are traded internationally, with prices influenced by global supply and demand. Most are priced in U.S. dollars, and their markets are affected by developments across multiple countries and regions.

Price Volatility

Commodity prices can be highly volatile due to external shocks like weather events, geopolitical conflicts, and sudden demand changes. Volatility can create both risks and opportunities for investors and producers.

Supply-Driven Cycles

Many commodities experience boom-bust cycles driven by production levels. Oversupply can push prices down, while supply shortages can lead to price spikes. These cycles often take years to play out due to the time required to scale production up or down.

Demand Sensitivity

Commodities respond quickly to shifts in global economic activity. Industrial metals like copper and aluminum, for instance, rise in value during periods of strong construction and manufacturing demand, and decline when economies slow down.

Low or No Yield

Unlike stocks or bonds, most commodities do not produce income. They don’t pay dividends or interest. Their value comes from capital appreciation, making them less attractive for income-focused investors. An exception is physical gold - large holders (like central banks or institutional investors) sometimes earn small yields by lending gold to bullion banks in return for a fee.

How commodity prices are set

Commodity prices are typically anchored to standardized benchmarks - reference prices that are widely accepted in the industry for a specific grade, quality, and location of a commodity. These benchmarks bring transparency & consistencyto an otherwise chaotic global market.

1. Benchmark Pricing

A benchmark price is the accepted standard rate for a specific commodity, often quoted in global markets. Common benchmark examples:

- Brent Crude (North Sea oil):global benchmark for crude oil.

- WTI (West Texas Intermediate): US benchmark for crude oil.

- Gold (London Bullion Market Association - LBMA): sets global gold price twice daily.

- LME Copper: pricing set by the London Metal Exchange for base metals.

- CBOT Wheat: Chicago Board of Trade benchmark for wheat futures.

- ICE Sugar No.11: key benchmark for raw sugar pricing.

Prices for other grades or local markets are often set at a premium or discount to these benchmarks, depending on quality, transportation costs, and regional factors.

2. Futures Market Pricing

A huge chunk of commodity prices is determined by futures markets, where buyers and sellers agree on a price today for delivery in the future. These markets (like CME, ICE, and LME) serve as price discovery platforms, reacting in real time to global news, weather, politics, and investor sentiment.

The spot price (the current market price for immediate delivery) is often influenced by these futures prices, especially in highly liquid markets.

3. OTC & Physical Market Negotiation

In less standardized markets (like rare earths, uranium, or certain agricultural goods), prices are negotiated directly between buyers and sellers in over-the-counter (OTC) deals. These can be influenced by private contracts, regional supply/demand, transportation / logistics costs, quality grades.

4. Index Providers & Price Reporting Agencies

Third-party firms like Platts, Argus, and S&P Global play a major role in publishing price assessments based on market surveys, trade data, and transaction reports. These are especially important in energy, metals, and shipping markets where formal exchange-based pricing is less dominant.

2. What drives commodity prices?

Commodities respond quickly to real-world events - often faster than stock markets. Here are some examples:

🛢️ Oil prices move on war, supply shortages, OPEC actions, and geopolitical turmoil.

🌾 Wheat prices are impacted by war, export restrictions, and drought in key grain-producing regions.

🔥 Natural gas prices are affected by supply disruption, low storage, and cold weather.

🥇 Gold is moved by financial instability, inflation hedging, and market anxiety.

🔧 Copper is influenced by demand for construction and industrial activity.

🍬 Sugar reacts to food inflation and agricultural shocks.

🌲 Lumber moves with natural disasters and housing booms.

2.1 Weather Events

Extreme weather patterns can disrupt supply and production, especially for agricultural commodities. Droughts, floods, wildfires, hurricanes, and heatwaves can damage crops, reduce yields, and affect energy demand and supply chains worldwide.

2.2 Geopolitical Events

Wars, sanctions, and political instability can directly affect the supply of key commodities such as oil, gas, wheat, and metals. Export restrictions, embargoes, or nationalization of natural resources can trigger immediate price spikes and global shortages.

2.3 Macroeconomic Factors

Interest rates, inflation, currency strength, and overall economic growth play major roles in commodity pricing. A strong dollar often pressures commodity prices lower, while inflation and global expansion tend to push prices higher. Industrial demand, particularly from countries like China and India, also drives long-term trends.

2.4 Supply Chain Disruptions

Even when production is stable, logistical challenges can affect availability. Port closures, shipping delays, labor strikes, and rising transportation or storage costs can all restrict supply flow and raise prices. Efficient logistics are critical to maintaining stable commodity markets.

2.5 Government Policies & Regulation

Policies such as export bans, tariffs, subsidies, and environmental regulations shape how commodities are produced and traded. Changes in policy can encourage or restrict production, alter global trade balances, and influence investment decisions in resource-heavy industries.

2.6 Technological Shifts

Advancements in technology reshape both supply and demand. The growth of electric vehicles has increased demand for battery metals like lithium and nickel, while renewable energy adoption reduces dependence on fossil fuels. Improved mining, drilling, and agricultural methods can also lower production costs over time.

2.7 Market Speculation & Sentiment

Short-term price movements are often driven by traders and institutional investors rather than physical supply and demand. Futures positioning, hedge fund activity, and market sentiment can amplify volatility and create sharp fluctuations disconnected from fundamentals.

In essence, commodity prices are shaped by a dynamic mix of physical realities, economic cycles, and human behavior. Understanding how these forces interact is key to grasping why markets move the way they do.

Platforms like Sara AI are beginning to use artificial intelligence to forecast commodity price movements based on global data trends.

3. Ways to invest in commodities

There are multiple ways to gain exposure to commodities, including: stocks of commodity producers, commodity futures and options, ETFs, physical ownership, and emerging instruments like price action tokens (PATs).

3.1 Stocks of Commodity Producers

Investing in the stocks of companies that produce commodities (mining firms, oil & gas giants, agricultural businesses, etc.) offers indirect exposure to commodity prices.

When the underlying commodity rises in value, these companies often benefit from improved margins and revenue growth.

Unlike direct commodity investments, these stocks may also pay dividends and are influenced by factors like management decisions, operational efficiency, and broader equity market trends.

3.2 Commodity Futures & Options

Futures and options are derivatives that allow investors to speculate on or hedge against future movements in commodity prices.

Futures obligate the buyer or seller to transact at a predetermined price and date, while options provide the right, but not the obligation, to do so.

These instruments are highly leveraged and can be volatile, making them suitable for experienced investors or institutions with risk management strategies in place.

They are widely used in markets like oil, natural gas, corn, and gold.

3.3 Commodity ETFs

Commodity Exchange-Traded Funds (ETFs) offer an easy way to gain exposure to commodities without holding the physical asset or trading futures directly.

Some track the price of a single commodity (like gold or crude oil), while others invest in a basket of commodities or the stocks of commodity-producing companies.

ETFs are accessible through regular brokerage accounts, making them a popular choice for retail investors looking for diversification and liquidity.

3.4 Commodity Physical Ownership

Physical ownership involves buying and storing the actual commodity (gold bullion, silver coins, uranium).

This method removes third-party risk and gives the investor direct exposure to the commodity itself. However, it comes with challenges: storage, security, insurance, and sometimes lack of liquidity.

It's most common in precious metals, where long-term holders view it as a store of value or hedge against inflation.

3.5 Price Action Tokens

Price Action Tokens (PATs) are bringing commodities to the world of Blockchain, Crypto & Decentralized Finance (DeFi).

PATs are synthetic instruments that replicate the price movements of commodities without requiring physical ownership or storage.

Example: Instead of trading Uranium (which is bulky, highly regulated, and costly to store) investors can trade Uranium PATs, digital wrappers that mirror Uranium's market performance.

PATs can be used within DeFi platforms for strategies like earning yield or using them as collateral-without needing to hold the physical commodity.

4. Risk Factors in Commodity Investing

Investing in commodities offers diversification and inflation protection, but it also comes with significant risks. These risks can be volatile, interconnected, and sometimes difficult to manage, especially for beginners. Understanding them is essential before allocating capital to any commodity-related asset.

4.1 Price Volatility

Commodity prices can swing dramatically in short periods due to changes in weather, demand, supply shocks, or geopolitical news. This volatility makes it difficult to time the market and can lead to large losses if not properly managed.

4.2 Leverage Risk

Many commodity investments, especially futures and options, involve leverage - borrowing money to control large positions. While leverage can amplify gains, it also increases the risk of significant losses and margin calls in fast-moving markets.

4.3 Geopolitical and Regulatory Risk

Commodities are often tied to countries with unstable political environments. Nationalization of resources, export bans, sanctions, and policy changes can severely disrupt supply and impact prices, sometimes overnight.

4.4 Currency Risk

Commodities are typically priced in U.S. dollars. For investors in other currencies, fluctuations in exchange rates can impact returns even if the commodity price remains unchanged in USD terms.

4.5 Storage and Logistics Risk

Physical ownership of commodities like oil, grain, or metals involves storage, security, insurance, and transport costs. Delays, losses, or inefficiencies in logistics can erode profits or cause financial loss.

4.6 Demand Shifts

Sudden changes in global demand (due to recessions, pandemics, or technology shifts) can reduce the value of a commodity investment. For example, declining demand for coal due to clean energy transitions has negatively affected long-term investors.

4.7 Speculative Bubbles

Investor sentiment can push commodity prices far above their intrinsic value. These bubbles are often followed by sharp corrections, hurting late entrants or passive investors who are unprepared for the downside.

4.8 Environmental and ESG Risks

Commodities tied to deforestation, high emissions, or unethical labor practices may face regulatory backlash, investor divestment, or reputational damage. ESG (Environmental, Social, and Governance) factors are increasingly relevant in commodity investing decisions.

Understanding these risks doesn't mean avoiding commodities. It means investing with awareness. With the right risk management tools and realistic expectations, commodity exposure can be a valuable part of a broader portfolio strategy.

Start your commodity investing journey with the free Commodities Investing 101 course by Rohas Nagpal.